I really want to believe that Snapchat can succeed, and show that a smaller player in the social media market, which is reliant on its relationship with its audience, can challenge the bigger, billionaire-backed giants in the space.

But right now, I just don’t see it.

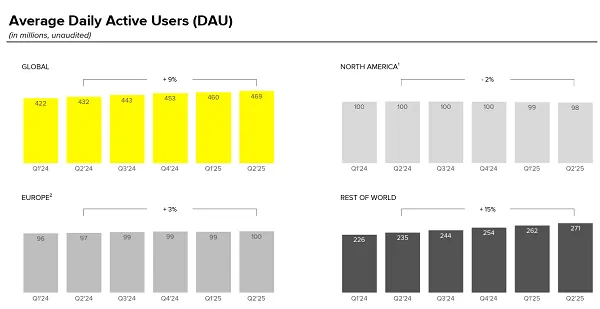

In its most recent earnings announcement, Snapchat reported a decline in U.S. users, while also posting lower-than-expected revenue numbers.

The trends here don’t bode well for the app, while its costs also continue to rise, and with Snap looking to directly challenge Apple and Meta on AR glasses as a key foundation of its next-level push (with a device that, by all accounts, will not be up to the same standard as these other options), I don’t see how it’s going to be able to improve its margins in a significant way.

And clearly, Snapchat founder and CEO Evan Spiegel also shares at least some of these concerns.

This week, Spiegel has published an open letter that he sent to Snap staff to mark the app’s 14th birthday, in which he outlines its current market position, its future opportunities, and how he hopes to capitalize on its potential.

And on a positive note, Spiegel says that Snapchat is “on the verge of greatness,” though he also says that Snap is “in a crucible moment,” which could make or break the company over the next while.

And on the latter, I agree with him.

Spiegel’s big hope is that Snap can manage costs, maximize its advertising opportunities, and reaffirm its business foundations over the next two years.

Spiegel’s view would see Snap reach a billion users, and $6 billion in revenue by the end of 2025. Snap’s currently on track to bring in around $5.5 billion for the year, and has 932 million monthly active users, so this is not an unrealistic goal, but the challenge for Snap lies in growth, and building on its opportunities when it seems to have plateaued in its key revenue markets.

So how will Snap reach the next stage, and will it be able to build its own AR glasses into a significant revenue element?

On the revenue side, Spiegel says that Snap will focus on medium-sized advertisers to generate more interest, which is a market segment that Snap hasn’t yet maximized. Spiegel says that Snap’s business development team has brought in 2,000 new activations this year, and its improving ad options are driving better performance.

In terms of specific ad opportunities and wins, Spiegel also notes that:

- Snapchat’s updated app advertising options have driven a 25% lift in app installs, and an 18% rise in unique converters among adoptees.

- Sponsored Snaps, which insert ads into Snapchat user inboxes, are delivering up to 22% more conversions, and nearly 20% lower CPAs

- Promoted Places have already shown double-digit visitation lifts in early testing

Snapchat+ is another consideration here, and Spiegel says that it will soon expand its paid add-on package with more features, including live-streaming functionality. Snapchat+ now has more than 15 million subscribers, exceeding the relative performance of paid add-on options of other social apps, though it also remains a minor part of the platform’s broader revenue pie. Snapchat+ will generate over $700 million for the app this year.

In combination, it is indeed possible that these projects will help Snap reach its immediate revenue goals, but the longer term concern is that if Snapchat has reached its limit in key revenue markets, that will ultimately cap its advertiser potential as well. So Snap may not have a lot of growth left.

Which leads to its other opportunities, and its focus, as noted, on AR glasses, a project that Snap’s been working towards for a decade.

Snap’s Spectacles have long seemed poised to make the leap into full AR functionality, but complex technical challenges have proven difficult for all developers to overcome. Yet, even so, Snap’s hoping to launch its first AR-enabled glasses next year, beating both Meta and Apple to the punch with functional, fashionable AR wearables.

Is that possible, and if it is, can Snap actually compete with the same from its more resourced competitors?

As per Spiegel:

“Specs are an enormous business opportunity. One pair of Specs can substitute for many screens. Our operating system, personalized with context and memory, compounds in value over time. A marketplace of digital goods, from spatial Lenses to virtual tools, has near-zero marginal cost and global reach. Specs are how we move beyond the limits of smartphones, beyond red-ocean competition, and into a once-in-a-generation transformation towards human-centered computing.”

So Snap’s clearly hoping that AR glasses will pose a real opportunity, but based on what we know about Snap’s device so far, it’s difficult to see how Spiegel and Co. will be able to capitalize on this vision, with better, more well-equipped, more functional AR glasses also coming from much larger competitors.

Basically, Snapchat’s AR glasses won’t be as good as Meta’s device. And with Snapchat also restrained by costs, which it’s actively working to keep down, I don’t see how Snap will see any real level of success, with what’s going to be a hugely expensive project.

And this is the real challenge, the real “crucible moment” for Snap. If its AR Spectacles aren’t a big success, its growth opportunities suddenly get very limited. Its audience reach is limited, which means its ad business will be somewhat constrained, and it’s already added ads into the inbox.

So what next? What happens when Snap can’t get rid of millions of its AR Spectacles that no one wants, and it can’t grow its U.S. and European audiences?

I suspect that AR glasses will indeed be the crucible inflection point that Spiegel’s referring to, and that they will end up being an anchor for Snap moving forward.

Snap doesn’t have its own AI infrastructure, relying instead on external partnerships, and it doesn’t have much room to move in shifting strategic priorities beyond this roadmap. If AR Spectacles fail, Snap suddenly becomes very confined, and when Meta’s AR glasses launch in 2027, I suspect that’s exactly where it will be.

Not that a billion users is bad, nor that Snap can’t maintain a business at a smaller scale. But with investors looking for constant growth, I suspect that Snap will be feeling the pressure moving forward.