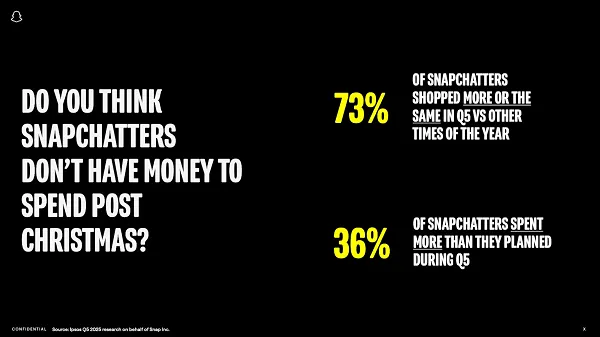

Snapchat is super keen to raise awareness of marketing opportunities in Q5, with recent Snap data showing that 88% of U.S. Snapchatters shop for gifts in the post-Christmas period.

The potential here could be a big winner in Snap’s end-of-year revenue push, and it’s looking to raise awareness among advertisers to boost ad spend in the period.

To further underline this, Snapchat recently commissioned Ipsos to conduct a survey of over 5,711 consumers across five markets, in order to glean more insight into how they plan to shop post-Christmas this year.

And if you’re still mapping out your holiday marketing plan, it may be worth keeping some budget for Snap ads in Q5, based on these insights.

First off, the data shows that 60% of consumers continue shopping after Christmas, with Snapchat users, in particular, looking to buy in the period.

As per Snap:

“With gift cards to spend, time off to relax, and budgets planned ahead, Snapchatters see Q5 as their moment to treat themselves and others.”

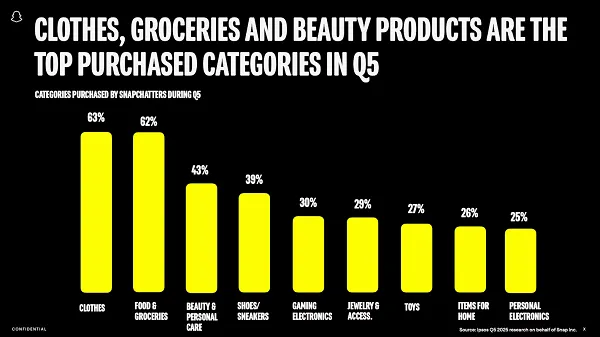

The data also shows that consumers are (logically) shopping more for themselves than others in the post-Christmas period, with fashion, beauty, electronics and food among the top-selling categories.

The report also shows that Snapchatters are more active in Q5, as they look to connect with friends, and share holiday snaps:

“In fact, New Year’s Eve is the #1 engagement day on Snapchat, making it the perfect moment for brands to connect.”

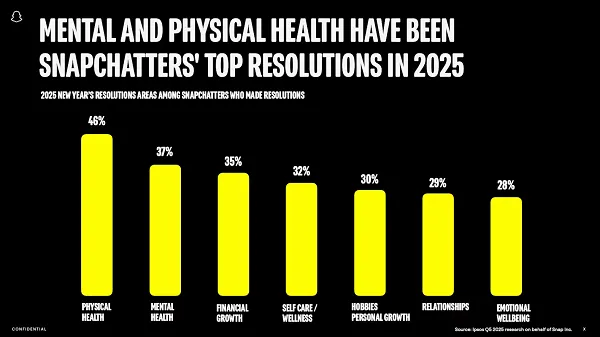

And there’s also the New Year's resolutions to consider, and the marketing opportunities within those self-pledges:

So there are ample opportunities to connect and encourage shopping behavior in the period, which could make it a valuable consideration for your marketing and outreach efforts.

Of course, Snap has its own motivations for pushing this element. With Australia set to increase its social media age limit to 16, and other regions considering similar, Snap could be particularly hard hit, losing its connection with a significant chunk of its younger audience. Which could harm its ad potential moving forward, so it makes sense for Snap to be making a push now, in order to boost its ad sales however it can.

But the data does highlight some valuable opportunities, and potential for brands.

You can read Snapchat’s Q5 insights report here.