China is not only the world’s largest social media market, but it also boasts an incredibly rich and diverse online landscape. After all, over 800 million Chinese internet users are looking for a place to share their opinions, ask for product recommendations, and connect with others. That’s a lot of content.

While Facebook, Instagram, and Twitter continue to dominate the western world, China has seen the emergence of many innovative new social platforms, including video sharing platforms like Douyin (now known locally as TikTok), and shopping communities like Xiaohongshu.

In this ever-changing environment, global brands looking to build their presence in the Chinese market need to keep a close eye on what’s happening with these platforms. In this post, we’ll introduce you to some of the most important Chinese social media sites, and examine the opportunities for businesses on these platforms in 2019.

But first, let’s start with a more fundamental question:

Why is Chinese social media important for global brands?

The numbers tell you everything - according to a Chinese government study, 802 million people in China are now active internet users, amounting to some 57.7% of the country’s population.

Compare that to the US’s estimated 300 million internet users (78.2% of the population). While China might not yet have the same market penetration, it has a greater potential for growth.

Even more interesting is the incredible level of mobile uptake in China - 98% of Chinese people using the internet do so via mobile devices, compared to just 73% in the US. This makes Chinese social media more immediate and dynamic, with mobile users looking to platforms like WeChat and Weibo for the latest recommendations, testimonials, and tips.

This high mobile penetration also helps drives the performance of massive online events like Alibaba’s Singles Day.

Alibaba employees celebrate 213.5 billion yuan ($30.7 billion US) in Singles Day 2018 sales. Source: CNBC.

For global brands, the sheer size of the Chinese consumer market makes it critical to dedicate time and energy to tracking trends on social media. Not only is China a significant market, but a lot of popular trends in wider Asia start in China.

Unfortunately, many brands struggle to understand the Chinese market in depth, and lack the ability to track local trends in real time. To see this in action, just look at the outrage and subsequent public apology over Dolce & Gabbana’s promotional videos for its 2018 runway show in Shanghai.

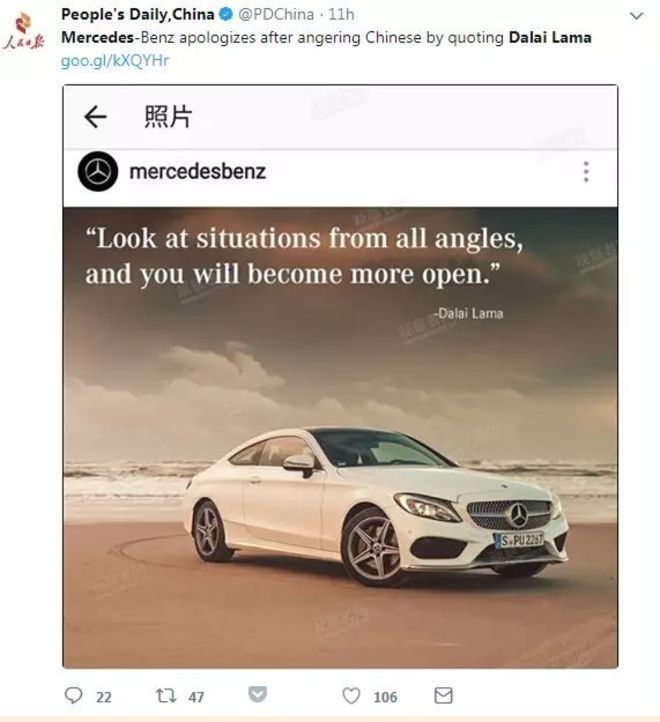

Mercedes Benz found this out the hard way too - in early 2018, the company had to apologize to Chinese consumers after featuring a quote from the Dalai Lama on its Instagram page. The Dalai Lama is considered a divisive political figure in China.

Incidents like this demonstrate just how valuable the Chinese market is to international brands, and how important it is to consider how advertising and marketing activities may be perceived at the local level.

This is where social listening comes in.

Tracking and observing exchanges on Chinese social media platforms is a great way for brands to build a deeper understanding of local perceptions and values, and can help avoid the risk of embarrassing - and costly - marketing missteps.

With that in mind, let’s take a closer look at what makes Chinese social media unique.

What makes Chinese social media unique?

Chinese social media platforms are highly focused on attracting mobile users, meaning sites are geared for quick and instantaneous sharing.

Unfortunately, this strong mobile focus presents difficulties for social listening. Businesses need special expertise to track and analyze online discussions about brands, products, and topics.

As western social media platforms like Facebook, Instagram, and Twitter struggle to get a foothold in China, Chinese social media companies step up and take the opportunity to innovate. This has led to the rise of a huge number of social media platforms, giving users more choice.

Rather than being dominated by a small group of companies, the Chinese social media landscape is more dynamic, with platforms rising and falling on a faster timescale.

Photo touch-up app Meitu is a great example - following significant user loss in 2017, Meitu shifted its focus from simple photo editing, allowing users to post updates and chat in groups. Since early 2018, Meitu has seen a tenfold increase in user engagement.

Meitu in action. Source: Nikkei Asian Review.

Finally, these large user numbers allow Chinese social media platforms to gather a rich volume of content at the local level - rather than reading depersonalized or bland product reviews, users can access meaningful, in-depth content tailored to their interests and location.

To see all of this in action, let’s look at nine top Chinese social media sites to watch in 2019.

9 Chinese social media platforms to watch in 2019

1. WeChat

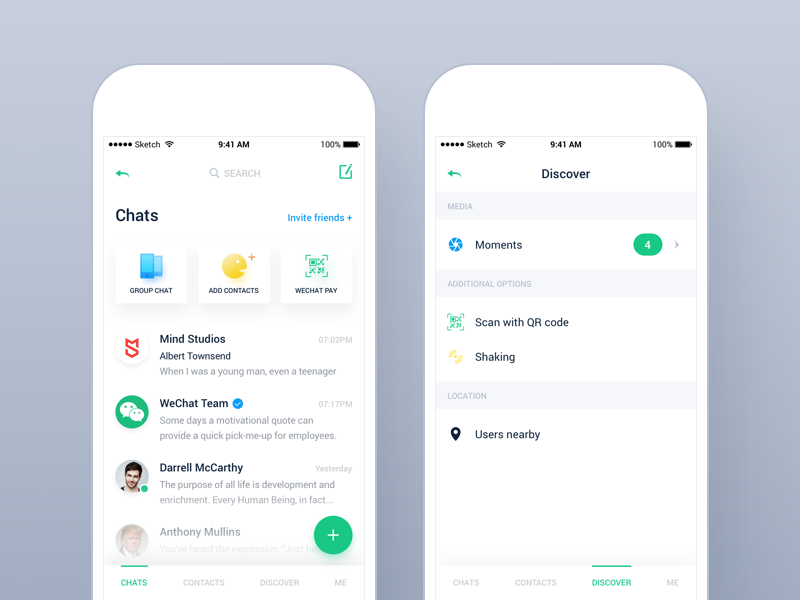

The true goliath of social media in China, WeChat boasts a massive monthly active user count of over 1.06 billion.

Developed by Tencent, this versatile app offers pretty much everything - online shopping, games, financial services. Combine this with its huge audience, and you have an unbelievably rich source of potential customer engagement.

Often described as a mix of apps, WeChat is the equivalent of Facebook, Instagram, Skype, Uber, Amazon, and Whatsapp, and also features integration with over ten million third-party apps.

WeChat also allows international brands to sign up for subscription and public accounts, enabling them to market content to WeChat users in different ways.

WeChat is also increasingly venturing into eCommerce, using what it calls ‘mini programs’ embedded within its platform to offer things like discount coupons and ride-hailing. Given the size of WeChat’s user base, this has the potential for huge growth.

2. Tencent QQ

Instant messaging app Tencent QQ remains a major player in the Chinese market, with 803.2 million monthly active users as of August 2018.

Like WeChat, QQ offers a bunch of different services, including gaming, music, movies, blogging, and group chat. This mix of services has made the platform incredibly popular with users under 20, attracting a dedicated user base for this older platform.

QQ includes a high degree of marketing functionality, enabling users to publish ads and links to friends. QQ also offers a paid marketing feature, allowing users to pay Tencent to create and publish content for products.

For global brands wanting to make their mark in China, Tencent QQ is definitely a platform to keep an eye on.

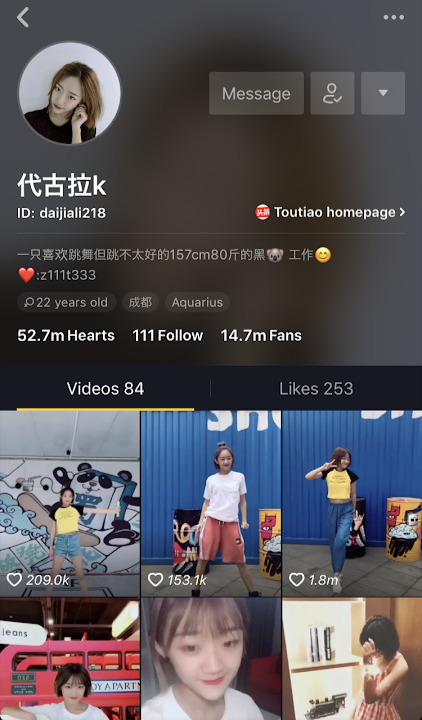

3. Douyin (TikTok)

Short-form video app Douyin has experienced a rapid rise since its initial release in September 2016.

Designed to allow users to create and share short videos, Douyin has become incredibly popular, attracting 500 million global users, which now includes over 6 million users in the United States.

Sometimes referred to as a “lip-synching” app, Douyin has become popular particularly among younger users, who use the platform to create and share short, punchy clips laden with memes and niche cultural references.

Like the now-defunct Vine, Douyin features an addictive feed, promoting videos from users all over the world and offering a mix of strange, creative, and irreverent content.

This unique offering has helped Douyin to hit some truly crazy numbers lately, including attracting a massive 75 million new users in just December 2018 alone.

For brands looking to engage a younger audience, Douyin is a key platform.

4. Meitu

Meitu - which translates roughly as “beautiful picture” - is a photo touch-up and sharing app with over 455 million active monthly users. With Meitu, users can upload pictures and edit or airbrush them quickly and easily.

Though the platform has attracted some criticism for promoting unrealistic standards of beauty and physical attractiveness, Meitu remains a popular site. Following a decline in user numbers, Meitu announced in April 2018 that it intended to focus more on the social aspects of the platform. Since then, it's seen a tenfold increase in user interactions. The company has even said it is positioning itself as the Instagram of China.

For brands in the beauty or cosmetics industry, Meitu is a key advertising tool. In fact, a number of luxury brands - such as Gucci and DKNY - are already using Meitu to promote their products.

5. Sina Weibo

Released in 2009, Sina Weibo has grown to become the most popular micro-blogging platform in China.

Sina Weibo users can upload GIFs, images, videos, and text to their networks, and this, combined with Weibo’s easy sharing functionality, enables Weibo to be a large source of trending content and information.

Best considered as a combination of Twitter and Facebook, Sina Weibo currently has 446 million monthly active users. And despite experiencing an overall decrease in user numbers in recent years, brands continue to use celebrities to build interest in their products on the platform - for example, Louis Vuitton announced a collaboration with Kris Wu, helping to drive a significant amount of online hype.

Many businesses - both local and international - rely on Sina Weibo as a source of real-time consumer reviews, and use the platform as a place to engage customer communities.

6. Meituan-Dianping

Meituan-Dianping - commonly referred to as ‘the Yelp of China’ - is a restaurant review and recommendation site. It also features elements of Groupon and Uber Eats, enabling users to order food directly from its app and tap into promotional offers at restaurants.

With 382.3 million users, Meituan-Dianping (which translates roughly as “everyone’s comments”) has become a major source of local food know-how. The service isn’t just limited to eateries either - users can also review gyms, hotels, bars, and a bunch of other things. With over 60 million reviews, Meituan-Dianping represents a rich source of consumer information on all kinds of businesses.

The huge degree of community participation on Meituan-Dianping makes it key for brands in China to pay close attention to what’s being said about them and their competitors.

7. Douban

Launched in early 2005, Douban is a social networking platform which enables users to connect and share content on a range of interests, including movies, television, books, music, and more. By 2016, Douban had already reached over 300 million monthly users, and that number continues to rise.

Often referred to as ‘the Chinese Reddit’, Douban can be considered a combination of IMDB, Goodreads, Pinterest, Twitter, and Spotify, all presented as one channel. With Douban, users can rate and recommend all kinds of media.

Douban also allows direct advertising to users, meaning global brands can target ads to niche users of the platform.

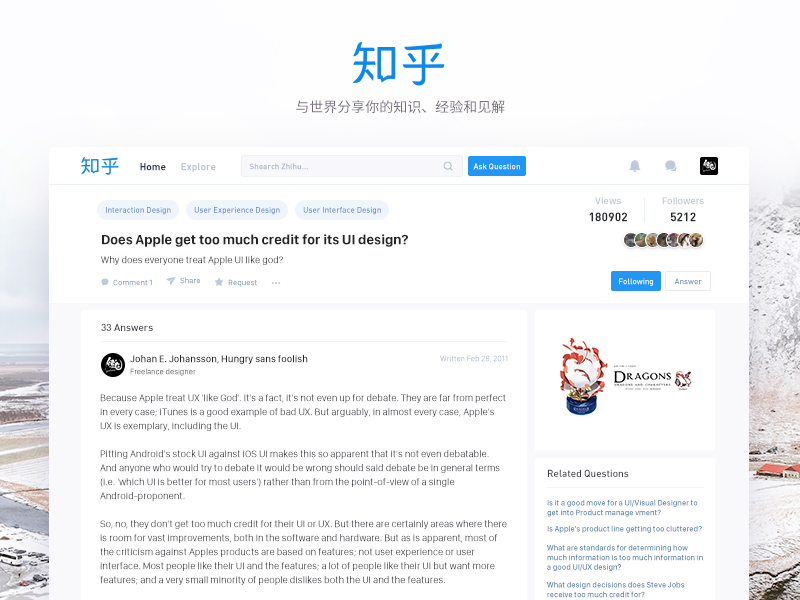

8. Zhihu

Commonly dubbed ‘the quora of China’, Zhihu is a popular question and answer site, boasting over 160 millions registered users.

Like Quora, Zhihu has a dedicated user base, with many users drafting detailed and impassioned responses to specific questions posed by other users. What’s more, Zhihu also features a bunch of innovative features, like users having the ability to “tip” providers of information and answer questions with sound recordings.

The popularity of this platform led Zhihu to raise $270 million USD in series E funding, cementing its status as a “unicorn” in China - a company with a valuation of over $1 billion USD.

And like Quora, Zhihu represents great advertising potential for brands, particularly within user timelines. Users come to Zhihu for answers to niche questions, creating the opportunity for targeted advertisements. What’s more, Zhihu’s users are mostly those from Tier 1 cities, and tend to be well-educated and with a higher income.

9. Xiaohongshu

Xiaohongshu, or the ‘Little Red Book’, is a mixed-use platform combining Pinterest-style photo sharing and eCommerce functionality. It currently serves over 100 million active users.

Geared primarily towards women between the ages of 18 and 35, the Little Red Book enables users to post product reviews, start discussions, and upload their own content.

This platform focuses almost exclusively on offering trusted product reviews and experiences, and is a rich source of tips for a lot of young consumers. The content on Xiaohongshu has resonated strongly with users struggling to find realistic and in-depth information and reviews.

The Little Red Book can also be incredibly lucrative for Key Opinion Leaders (KOLs) looking to influence sales for brands through their content.

So, that’s a quick look at some of the most important Chinese social media platforms in 2019, now, let’s examine the opportunities for global brands to utilize these platforms.

How global brands can leverage Chinese social platforms in 2019

Chinese social media’s combination of huge user numbers and platform variety presents a significant advertising opportunity for global brands.

Brands and businesses are recognizing this opportunity, and are creating bespoke content for many of these platforms. This includes offering flash sales on WeChat, using KOLs on Xiaohongshu, and targeting Zhihu users with niche product offers.

Here are a few more examples:

- On September 17 2018, Burberry offered an exclusive WeChat flash sale to its 12 million followers followings a major catwalk show.

- On November 16 2018, Dior used WeChat’s live-streaming feature to attract more than 3.2 million viewers, helping to drive sales.

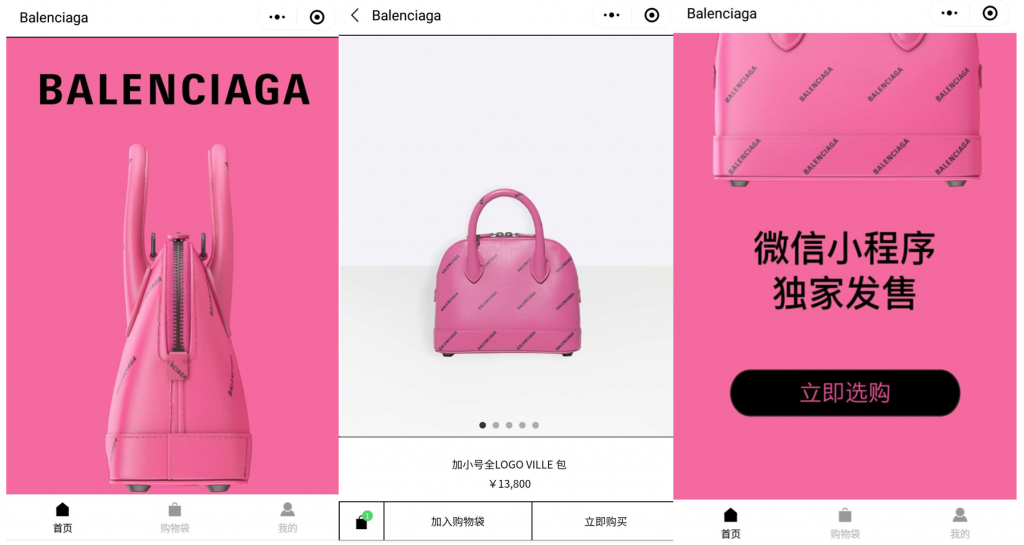

- On January 16 2019, Balenciaga offered a limited edition handbag via a WeChat mini program, stirring up a massive amount of online hype.

Balenciaga’s WeChat mini-program offer. Source: Jing Daily

Balenciaga’s WeChat mini-program offer. Source: Jing DailyRecently, Xiaohongshu began offering its a “brand partner platform”, a service where brands can be connected with influencers to arrange for sponsored content. Since unveiling this service, many luxury brands (including YSL, Shiseido, and Fendi) have entered into official collaborations with KOLs, using Xiaohongshu to drive online interest.

Insight is everything

These examples each highlight the opportunities for brands to take advantage of different platforms, and expose their products to new groups of users.

However, to identify potential marketing opportunities and avoid the risk of missteps, brands need a deep understanding of what’s being said on Chinese social media. Because the Chinese social media landscape is so complicated, brands need human expertise, based on great data, to provide analysis and insights.

Platforms like Linkfluence can help in this regard - working directly with the Chinese social media platforms and local data providers, Linkfluence can provide comprehensive coverage of real-time global and local insights.

For global brands wanting to take advantage of the huge opportunities offered by Chinese social media, working with a social listening company with comprehensive coverage and local researchers can make all the difference.

Invest in Chinese social media platforms to stay ahead

In this post, we’ve looked in depth at some of the unique features of Chinese social media, and have examined eight important social media platforms to watch in 2019.

Chinese social media changes every day, making it crucial for global brands to have a detailed understanding of what’s happening at the local level, and what users are saying.

If you’re a brand looking to stay relevant in China, we suggest keeping a close eye on developments with these platforms, and thinking about how social media intelligence might help.