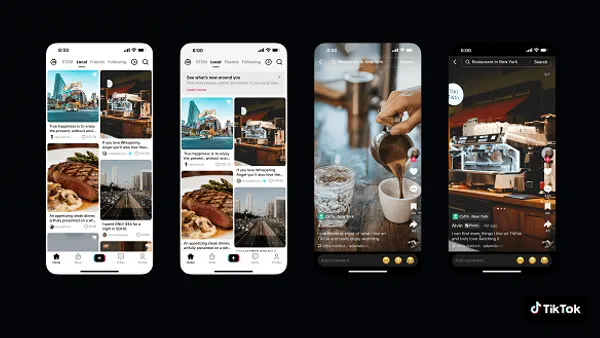

As part of its expanded effort to get more people buying products in the app, TikTok is offering retailers a raft of incentives for the holiday season, ranging from covering the costs of delivery, to significant cash incentives, based on sales growth.

Indeed, TikTok is reportedly offering some TikTok Shop merchants up to $20k in incentives based on sales growth in the app.

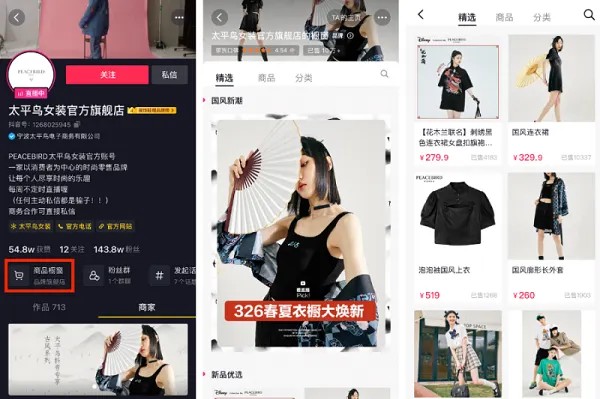

This is all part of TikTok’s major push to convert the platform into an eCommerce superpower, re-creating the same path to success that the app saw in China, with the local version of the app.

On Douyin, the China-only version of TikTok, live shopping, in particular, has been a big winner, with the platform generating $US490 billion in gross merchandise sales in 2024. Douyin has expanded its in-stream sales to all elements of shopping, including groceries, meal delivery, and more.

That’s made the platform a key element in the lives of millions of young Chinese users, and solidified Douyin as an essential app, beyond just trending video clips.

But what’s been even more impressive here is Douyin’s rapid ascent, with the platform going from virtually no commerce activity at all in the app in 2019, to that $US490 result last year. That’s the template that parent company ByteDance has been working from in its efforts with TikTok, however Western consumers have been less keen to integrate shopping into their TikTok stream.

But there are signs that things are changing in this respect.

According to reports, TikTok Shop saw a major sales increase in Q3, putting the app on track to post a massive jump in overall sales volume for the year.

As reported by Digiday:

“Between September 2023 to August 2024, TikTok Shop recorded $1.1 billion in gross merchandise value (GMV), and shifted around 67 million units of stock, according to data from Charm.io. This increased to $2.5 billion GMV and around 139 million units of stock between September 2024 and August 2025.”

So even though it’s not reaching the heights of Douyin, TikTok shop sales are increasingly steadily, and TikTok’s hoping that this will eventually enable it to replicate its shopping success in Western markets.

Though its slower progress has frustrated its Chinese management, who’ve often blamed differences in Western work culture for slowing its eCommerce development.

Though the variation seems mostly aligned with broader cultural differences, with Chinese users showing a greater preference for integrated apps, which enable them to undertake a range of tasks on one platform, while Western users seem more content to keep social/entertainment and shopping apps separate.

Those lines are blurring over time, as demonstrated by Pinterest as well, but they’re unlikely to replicate Chinese app adoption trends for some time yet.

Which will likely continue to frustrate TikTok ownership, even if it does see a major sales boost this year.

TikTok’s future in the U.S. will also play a key part. America is TikTok’s biggest revenue market, and if the app is eventually banned in the U.S., that’ll put a big dent in TikTok’s global shopping takeover plan.

So what does that mean for TikTok sellers? Well, for now at least, TikTok clearly remains focused on boosting sales, and promoting sales in the app, which means more opportunity for retailers looking to tap into this push.

But if TikTok’s management continues to be frustrated by slow progress, in comparison to Douyin, and TikTok suffers restrictions in foreign markets, that could have an impact on this element. Which could see less focus on in-stream shopping, even though it’s increasing sales year-over-year.